China is the single largest electric vehicle market in the

world. In 2020, 1.3 million electric vehicles

were sold in China. This represented 41%

of global electric vehicle sales, which is just behind Europe, with 42% of

global electric vehicle sales. In

contrast, electric vehicle sales in the US represented only 2.4% of sales, and 0.5%

of all cars sold in India. Analysts

forecast that 1.9 million electric vehicles will be sold in China in 2021, a growth

of 51%, and a market share of 9% of all cars sold in China. All this tells us that global sales for electric

vehicles have a lot of room to grow in the next decade.

These are my thoughts on business development and management issues. I worked for years as a consultant and in various positions in the logistics and maritime industry. We have handled projects from training and development to corporate imaging and branding.

28 April, 2021

Electric Vehicle Market Share

Electric Vehicles Gaining Acceptance

Electric Vehicles with Lithium Batteries is Not the Solution

Current electric vehicles are not as environmentally friendly as advertised. Most modern electric vehicles use what is essentially a souped up compound handphone battery. That means lots of lithium in all those batteries.

The battery of a Tesla Model S, for example, has about 12 kilogrammes of lithium in it. The grid storage needed to help balance renewable energy would need a lot more lithium given the size of the battery required. Because manufacturers are secretive about the technology of their batteries, effective recycling is virtually impossible. Most of all that lithium ion batteries end up in landfills, where then seeps into the environment as they break down, poisoning the water table and contaminating the land.

Lithium cathodes themselves degrade over time. That is why they cannot be placed into new batteries. Lithium is a rare earth metal, which means it is reactive. As such, there have been a number of fires at recycling plants where lithium-ion batteries have been stored improperly, or disguised as lead-acid batteries, and put through a crusher. Not only have these batteries burned at recycling plants, but auto makers are seeing battery-related fires leading to vehicle recalls and safety probes. Teslas have this unhealthy tendency to explode on impact to the battery, spewing out toxic gas and acid which cannot be put out by water. Chevy Bolts spontaneously combusted the back seats where the batteries were.

The mining of lithium is even more environmentally damaging than drilling for oil. The land is effectively strip mined and rendered useless for everything else. Lithium extraction uses a lot of water, approximately 2 million litres per metric tonne of lithium. Miners drill holes in salt flats and pump salty, mineral-rich brine to the surface. After several months the water evaporates, leaving a mixture of manganese, potassium, borax, and lithium salts, which is then filtered and placed into another evaporation pool. After from 12 and 18 months of this process, the mixture is filtered sufficiently that lithium carbonate can be extracted.

There is the potential leak of toxic chemicals, such as hydrochloric acid, from the evaporation pools into the water supply. In Australia and North America, lithium is mined from rock using chemicals to extract it into a useful form. Lithium mining has proven negative environmental impact in water sources, streams, the sea and land for hundreds of kilometres around. Lithium extraction also harms the soil and causes air contamination. For example, in Argentina’s Salar de Hombre Muerto, lithium mining contaminated streams used by humans and livestock and for crop irrigation, leading to a significant spike in cancers and other disease. In Chile’s Atacama salt flats, one of the most beautiful places in the world, mountains of discarded salt and canals filled with contaminated water with an unnatural blue hue. It is estimated that between 2021 and 2030, with this global push towards electric vehicles, about 12.85 million tonnes of EV lithium ion batteries will go offline worldwide, and over 10 million tonnes of lithium, cobalt, nickel and manganese will be mined for new batteries.

This is not a

green solution. A green solution is

electric vehicles using graphene batteries.

Graphene is a near superconductor at room temperature and pressure, powering

a vehicle that will have consistently superior performance as the technology matures. Graphene is made from carbon, which comes

from trees. At Quantum Age, we grow

those trees, reforesting hundreds of square kilometres, and harvest them

sustainably for the carbon fibre bodies of our vehicles, and the graphene for

our patented batteries. We are that

solution; we are the future – a quantum leap in technology.

27 April, 2021

Problems with English: “Building”

Over-Emphasising Shareholder Value

One of the mistakes from the 80’s “Greed is Good” era of Corporate

America was this excessive emphasis on shareholder value. Shareholders are one of several

stakeholder. Customers and clients are

stakeholders. Vendors and partners are

stakeholders. Employees are a major

stakeholder of a business. A company

that only emphasises shareholder value will inevitably fail since the focus is

on immediate gain, not long-term market growth.

This sort of thinking still plagues investment banking, and fund management,

which leads to excessive risk, and eventual cost that affects shareholders as

well. An overt emphasis on shareholder value to the

exclusion of everything else is self-defeating, and kills the business, the

environment, and even people sometimes.

The Concept of Quantum Mobility

Part of the process of putting out a superior electric vehicle is

not merely creating one with superior specifications, but considering the

manufacturing process, to bring down costs, and increase margins. This means having a distributed manufacturing

system of micro factories, and materials from our own Q-Paulownia trees for the

carbon fibre bodies and graphene batteries.

Thailand’s Electric Vehicle Push

Quantum Motors is looking to base one of its manufacturing in Southeast Asia in Thailand. This makes perfect sense. As of 2017, the Thai automotive industry is the largest in Southeast Asia, and the 12th largest in the world., with an annual output of near two million vehicles. Over half the market is pickups. Thailand manufactures for many foreign car companies under license.

Due to the large number of pickups, which use diesel, Thailand has

dangerous air pollution levels. Because of

this, Thailand is promoting an ambitious electric vehicle programme. This is an excellent opportunity to stake a

position here, and create strategic partnerships within an established

ecosystem.

Singapore Study on SPAC Exits

This is

important for us because we have SPAC proposals for our verticals. The primary concern about SPAC exits is the

interests of initial shareholders, and the dilution of controlling

interest. For those seeking an early

exit, a SPAC is an attractive option for a healthy return on investment. For those seeking to gain in the long-term,

and cash cow their investment, they want to ensure their interests are secured.

Leadership Begins with Giving

For leadership

to work in the modern era, the people being lead need to feel that their leader

is invested in them. We have moved past

the time of strict command-type environments.

In a capitalist society, the best and brightest have options. To lead that best and brightest, to even

attract them, involves selling them of vision of a collective that is greater

than the sum of its parts. To keep them

involves living up to it. Leadership in such an environment involves putting ourselves in the

shoes of the other. People are motivated

when they are made to understand what is in it for them.

26 April, 2021

Quantum Motors Micro Factories & Product Comparison

Quantum EV intends to put out a product superior to any electric vehicle in the market. Our vehicles are superior in terms of purpose, due to our graphene batteries. The use of graphene, as opposed to a reliance on lithium ion batteries eliminates a supply bottleneck, and is more environmentally friendly. Graphene is a superior conductor, and that translates into superior performance.

Our vehicles are also superior in terms of environmental impact,

from manufacturing process to finished product.

Because of the use of genetically created Q-Paulownia wood, we essentially

use carbon fibre bodies, as opposed to mild steel, which is stronger and

lighter. This is friendlier to the

environment.

Our production technique does not require a massive assembly plant,

but micro factories that can be deployed anywhere, to assemble kits. This means we are on the ground, manufacturing

in a new market in a matter of days, as opposed to months, reducing infrastructure

risk or political exposure in certain markets.

Our Quantum Motor Graphene Battery Generates More Torque than a Porsche 911 Turbo Engine

Quantum Age’s

graphene battery is superior to any electric battery in the market for vehicles. In the International System (SI), work is

measured in joules and, in rare instances, newton-meters (Nm). Torque is a rotating force produced by an

engine’s crankshaft. The more torque an

engine produces, the greater its ability to perform work. The measurement is the same as work, but

slightly different. In this instance, our

Quantum motor produced more torque, at 850 Nm than a Porsche 911 Turbo S. This allows our cars to go from 0 km/h to 100

km/h in 3 seconds or less. With an autonomy

in excess of 100 km, we could build a race car.

Generating Revenue from Q-Paulownia

A Wealth Tax Should Not be a First Option

A wealth tax is

not the way we want to go. The nature of

such taxes is that they will impact the mass affluent and HNW more than the VHNW

and UHNW. With enough money, it is

possible to create tax vehicles and hire the sort of tax and financial

consultants to avoid the brunt of those taxes, mostly through distinct legal

entities such as trusts. A legal entity

other than a natural person is taxed after expenses. The mass affluent and HNW generally got there

due to earning from professional work, such as doctors, lawyers, and other

specialists. They do not, yet, have

access to the level of financial advisory that the next tier of wealthy do.

Another point of consideration is that while the UK and the US have much higher taxes, despite being among the most competitive nations in the world, they have depth in their capital markets that countries as Singapore, and even Japan, do not. Nobody is rushing to list on the Tokyo Stock Exchange, and there is barely any secondary market for Singapore listings. Singapore’s competitive advantage is a low tax regime. This is how we attract talent.

We should consider raising the various forms of consumption tax,

not income and capital gains. This consumption

tax can be on a sliding scale so it does not adversely impact the lower socioeconomic

classes. This will not be enough, of

course. The main issue is that we need

to grow the tax base, not tax the shrinking tax base more.

Q-Paulownia Cultivation

Quantum Age Holdings Corporation has developed a new type of paulownia tree, the Q-Paulownia, which grows faster, which puts nitrogen back into he soil, and has many other uses. Red Sycamore’s electric vehicles use graphene from this tree to create superior batteries. The wood from the tree can be turned into a form of carbon nanofibers for the vehicle bodies. This makes our vehicles the most environmentally friendly, and sustainable. It is not just about the batteries. It is the entire process.

The Q-Paulownia project is not an agricultural project. It is a biotechnology project. We are not merely planting and harvesting trees. We are developing an independent ecosystem that can be spun off as a series of verticals, independently generating revenue.

Investing for a Legacy

Family Officers have been increasingly focused on sustainability as a measure of risk management. Companies that are serious to adhering to ESG guidelines tend to be less exposed to political risk, liabilities, and other risks such as litigation for pollution, for example.

Additionally, people who have substantial funds are no longer

investing merely for a return, but as part of legacy planning, they want to

drive positive change in the world. They

are putting their money in projects they believe in, in companies with values

they share, in places they have some sort of attachment to.

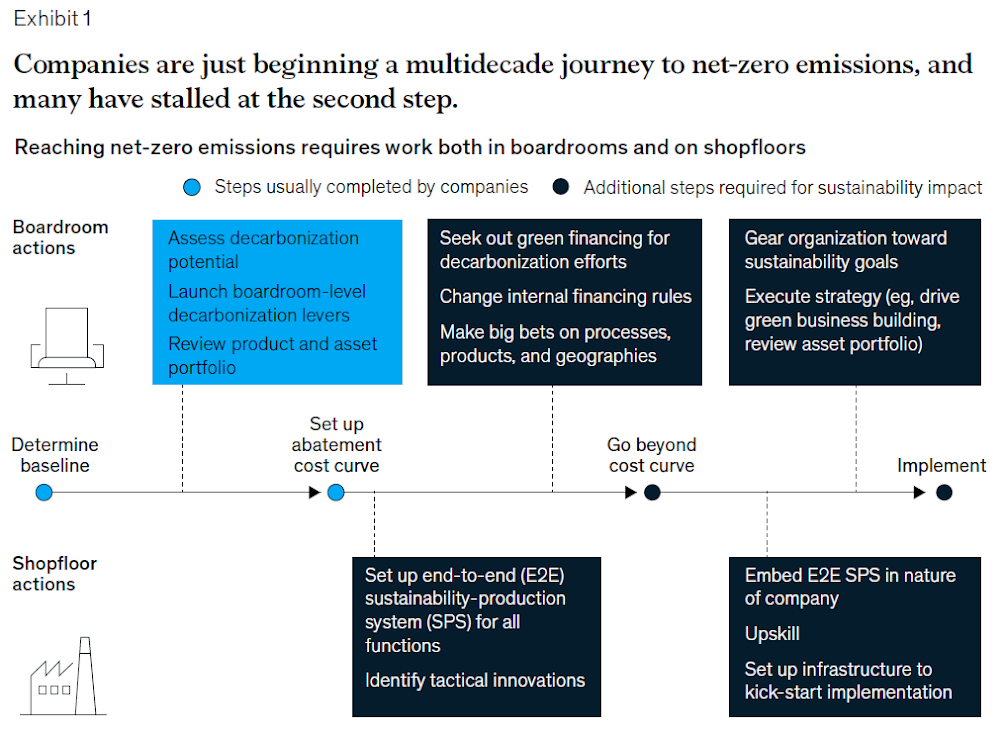

Net Zero or Bust: Beating the Abatement Cost Curve for Growth

In an age of activist consumerism and investment, and the apparent effects of climate change, moving towards net zero emissions is the stated goal of many businesses. The questions is how do we evolve it from slogan to reality? The following is taken from “Net Zero or Bust: Beating the Abatement Cost Curve for Growth”. This article was written collaboratively by global leaders in the McKinsey Sustainability and Manufacturing & Supply Chain Practices, including Pauline Blum, Stefan Helmcke, Ruth Heuss, Thomas Hundertmark, Sebastien Marlier, Dickon Pinner, and Ken Somers.

Companies can both decarbonise and boost long-term growth, but it means pushing beyond abatement curves’ focus on cost and instead empowering people, while making a few big, strategic bets.

Before the COVID-19 pandemic, environmental, social, and governance (ESG) issues had become priority concerns for governments, businesses, investors, and consumers. As the world looks forward to the post-pandemic next normal, these themes are likely to return to the top of executives’ agendas. Among them, the need to eliminate emissions of greenhouse gases may be the most difficult to address. Many companies have already committed themselves to deep, long-term reductions in greenhouse-gas emissions. Others will be forced to act by customers, investors, and governments. Almost 300 large companies have joined the highest tier of the Science Based Targets initiative, for example — that is, ramping up pressure on suppliers to cut their own emissions or risk losing business. Business leaders are already telling us that some of their biggest customers are warning that future contracts will be contingent on significant emissions reductions.

A growing share of investment capital is also being channeled into the fight against climate change. Between 2012 and 2018, investment in assets with explicit sustainability goals grew by 15% a year. By 2018, such investments accounted for 11% of professionally managed assets globally. More broadly, investors are increasingly concerned about the potential impact of climate-related risks across their portfolios. In January 2021, BlackRock, the largest asset manager in the world, asked the CEOs of companies in which it holds shares to explain how they plan to achieve net-zero emissions by 2050.

And policy makers are piling on further pressure. The European Union, for example, appears ready to proceed with plans for a cross-border carbon tax, using the proceeds to fund sustainability initiatives within the bloc. Such policies mean companies are no longer shielded from environmental legislation by virtue of their location. Any organisation participating in global supply chains will need to cut its emissions.

Together, these forces mean that decarbonisation is no longer an option. Across most of the world, companies with ambitions to stay in business over the long term are already on a 30- or 40-year journey to net-zero emissions.

Like any change journey, the road to net zero involves several distinct steps. Companies must understand their current carbon footprints, identify strategies to reduce and ultimately eliminate carbon emissions, and implement the necessary changes.

These steps would be straightforward, were it not for one catch. Emission-reduction plans tend to be created using standard “abatement curves,” which take a top-down view and focus on large-scale technological shifts. These curves often predict that transition risks, such as falling demand or asset devaluation or regulatory shifts, will lead to cost increases great enough to put many organisations out of business long before they reach their net-zero goals.

In our view, organisations should not let the scale of the challenge derail their sustainability ambitions. Contrary to what cost curves suggest, big cuts in emissions can be achieved without large-scale value destruction. What is more, the climate transition will create historic opportunities for environmentally sustainable businesses to build new markets, reinvent old categories, and become magnets for top talent. Unilever, for example, says that in 2018, its Sustainable Living brands grew 69% faster than the rest of its portfolio. And by 2030, the reuse and recycling of plastics could drive profit-pool growth of US$60 billion for the chemicals industry, according to McKinsey analysis.

For the journey to become value creating rather than value destroying, however, companies will need to rethink the conventional approach to carbon reduction. Moving beyond the abatement curve involves a combination of top-down and bottom-up activities: empowering frontline personnel to drive emissions reductions while making significant long-term strategic bets on markets, technologies, and production footprint (Exhibit 1).

Even the first step in the carbon-reduction journey — determining baseline emissions — presents significant complexities. An organisation can use internal data sources, such as energy bills and procurement records, to calculate its emissions in the Greenhouse Gas Protocol’s Scope 1 (direct emissions from its own activities) and Scope 2 (indirect emissions attributable to the organisation’s energy use). Scope 3 emissions are more difficult to ascertain. The necessary data are not always available from suppliers and customers, forcing companies to rely on models or approximations to build an estimate of their full carbon footprint.

Even a less-than-perfect picture of emissions could still act as a useful catalyst for improvement. Understanding the largest sources of greenhouse gas emissions across value chains can help companies identify quick wins and target energy efficiency improvement efforts. Few organisations make that link, however. Emissions analyses remain locked in the boardroom, while any improvements made by the front line are simply a byproduct of efforts to reduce waste and drive up productivity using well-established lean approaches.

To establish a potential pathway to net zero, companies must identify the changes that could eliminate emissions from their value chains, then rank them in ascending order of cost per ton of abated carbon. Today, it is common to map these changes in the form of abatement curves, which provide the boardroom with a top-down view of the potential capital investments (often large) in known technologies that could trim organisation’s emissions.

For business leaders, these abatement curves can be frightening, especially for industrial companies with energy-intensive processes. Exhibit 2 shows an illustrative carbon-abatement cost curve for the full value chain of a European automotive player.

The x-axis of the chart sets out, in ascending order of cost, the available options for reducing the organisation’s carbon emissions. The y-axis shows today’s cost of each option per ton of carbon emissions reduced. At current costs, less than 25% of the path to zero emissions is positive net present value (NPV).

For this company, the chart’s implications are stark. Eliminating the company’s upstream emissions would reduce its profits by around €1 billion. At many organisations, the implications of the carbon-abatement curve have been daunting enough to stall progress on the deep emissions reductions that will be necessary over the coming decades. The imperative for today’s leaders is to find ways to break this deadlock.

Beating the cost curve and building a successful long-term decarbonisation strategy will depend on big moves in two areas (Exhibit 3). The first operationalises emission-reduction efforts using known technologies and approaches, moving from theoretical discussion in the boardroom to pragmatic action in the control room, on the shopfloor, and throughout the organisation. The second entails big bets on options that don’t currently appear on the abatement curve, exploring new technical, strategic, and market opportunities to capture value while reducing environmental impact.

Translating emissions-reduction goals into a practical reality involves working on three fronts at once: redefining the decarbonisation business case in finance, building an integrated sustainability production system into the organisation, and assembling an infrastructure to support tactical innovation in operations.

Increasingly, organisations looking to finance emissions-reduction initiatives can access the necessary capital at low cost. Governments and private investors are showing a greater willingness to offer long-term loans at favorable terms to fund such projects. Sustainability-linked bonds worth more than US$200 billion were issued in 2020, for example, pushing the total market for such securities above US$1 trillion for the first time. Some programmes even offer borrowing costs linked to the carbon-reduction impact of investments. In February 2021, drinks maker AB InBev agreed to a US$10.1 billion credit facility that links interest margins to several sustainability goals, including group-wide carbon-emissions reductions. Using such structures, companies can often secure funds for investment at less than half of their existing cost of capital. That is enough to shift the NPV of plenty of emissions-reduction projects from negative to positive.

In the context of the transition to net zero, companies can also

revisit their project-investment criteria. At many organisations, projects that improve

efficiency or reduce emissions must today pass the same financial tests as any

other capital investment. That usually

entails a maximum payback period of two years. Extending the maximum payback period to five

years, for example, allows organisations to take a longer-term perspective on investments

that could make a meaningful difference in their climate-change impact.

Alternatively, companies can explore new funding and ownership models for low-emission assets. Original-equipment manufacturers or third-party operating companies may be willing to retain ownership of equipment such as biomass boilers, for example, while the end user pays by unit of energy consumed. In Romania, for example, specialty chemicals company Clariant is building a 50,000- ton capacity plant to produce ethanol from agricultural residues. Steam and electricity for the facility will be provided by a dedicated biomass cogeneration plant installed and operated by German energy company GETEC.

Another option for companies is to introduce an internal form of carbon tax by including the cost of the carbon emissions explicitly as a line item on the profit and loss accounts of their plants and business units. The funds collected through this mechanism can then be ring-fenced for use in emission reduction projects. Dutch chemicals company Royal DSM, for example, introduced such as scheme in 2016, setting an internal carbon price of €50 per ton.

Many organisations have dozens of potential emission-reduction projects sitting on their shelves because their business cases failed to meet the requirements for investment, sometimes by narrow margins. The combination of cheaper, more accessible capital and a full life-cycle perspective can unlock multiple opportunities to simultaneously reduce emissions and improve financial performance.

Designing, running, and improving a low-carbon manufacturing network and supply chain is an intricate task. Organisations will need the skills, processes, and data to identify and implement efficiency improvements across their operations. Today, all three are in short supply.

The development of an end-to-end sustainability production system will require a systematic approach to the acquisition and development of capabilities across the workforce. Companies will also need appropriate supporting infrastructure across the wider organisation. That might include investments in new analytical tools to help staff interpret sustainability-related data, and changes to KPIs, targets, and incentives to promote continuous improvements in energy and resource efficiency.

Several companies are already pursuing this approach. A large-scale, ten-year operational energy-efficiency programme at one major chemicals player focused on capability building among frontline process engineers. Hundreds of staff across the organisation developed the skills to understand the root causes of losses and process inefficiencies, aided by new analytical tools that helped them identify and evaluate the impact of detailed process changes.

The programme has reduced carbon emissions by 10% while generating savings of about €100 million per year. That impact was achieved not through big investments in new equipment but through dozens of smaller measures scattered across the business. One site alone implemented more than 30 separate projects. Notably, the company made no special financial provisions for efficiency improvements; projects had to demonstrate a three-year payback like any other investment.

The road to net zero involves several distinct steps. Companies must understand their current carbon footprints, identify strategies to reduce and ultimately eliminate carbon emissions, and implement the necessary changes.

The drive to reduce Scope 3 emissions generated in the upstream and downstream value chain, meanwhile, will require companies to extend their sustainability production systems to include functions such as procurement, product development, supplier development, sales, and logistics. Measuring, monitoring, and improving Scope 3 emissions in the upstream supply chain will demand extensive changes to current approaches to supplier selection and management, for example, along with new analytical skills in the responsible teams. Companies will want a comprehensive carbon accounting-and-control system that runs alongside its financial equivalent. Such systems are in their infancy today, but development is accelerating. In mid-2020, chemicals company BASF began to publish full details of the carbon footprints of the 45,000 products in its portfolio.

The transition will also require effective cross functional coordination. Carmakers are already exploring opportunities to replace high-quality, high-footprint virgin aluminum with lower-grade, low-footprint recycled aluminum. That calls for collaboration between product development, sourcing, and manufacturing teams. The ability to demonstrate better environmental performance can boost sales too. Some materials companies are already using their sustainability credentials and long-term improvement plans as an argument for their products over rivals’.

The third critical element required to operationalise a company’s carbon-reduction strategy is tactical innovation. Many of the moves required to drive down overall emissions will involve the adoption of new technologies and approaches, the costs and benefits of which may be highly site-specific. Half of the carbon emitted in ammonia production is pure CO2, for example — and therefore could be ideal for carbon capture and storage (CCS). In Europe, ammonia plants located close to ports have opportunities to transport this gas in marine tankers for storage in depleted offshore oil and gas wells. Our calculations suggest that this approach was cash-flow-positive even at the February 2021 carbon price of €40 per ton.

Similarly, advanced heat recovery, zero-carbon electricity, hydrogen, biomass, and geothermal and nuclear heat are all potential substitutes for the fossil fuels used to produce process steam. The best choice for a given site will depend on the local price, societal acceptance and availability of each fuel type.

Companies will need the ability to pilot and scale up new and unproven technologies within their existing production networks. That will involve partnerships with start-ups or research organisations to pursue breakthrough innovations — and it will also require adequately funded and supported in-house capabilities. Government support for such initiatives is increasingly available. The EU Innovation Fund, for example, plans to invest €10 billion on low-carbon innovation over the next decade, with funding earmarked for small-scale projects alongside flagship innovation efforts. One candidate for such tactical innovation might be the development of high-temperature heat pumps to reduce energy consumption in the food industry’s sterilisation and cooking processes.

Capex-replacement cycles present another opportunity for site-level innovations and technology investments. A steelmaker facing a €500 million investment to replace a coke oven battery, for example, might consider a switch to more efficient alternative technologies, such as a jet-process basic oxygen furnace. It could also choose to invest in electric arc furnace technology, switching the feedstock to direct reduced iron produced using natural gas with CCS, or using hydrogen.

Once again, these are decisions that cannot be left to the boardroom alone. The best answers for any site will depend on specific factors, including its location, the availability of low-cost capital or government support, and the strength of the organisation’s long-term commitment to the technology or market segment.

Proven and emerging technologies and operating approaches, if applied

at scale, will be enough to take energy-intensive companies perhaps 40% of the

way along the emissions-abatement curve. The remainder of the journey will require big

bets and big steps into the unknown. As

they consider those choices, businesses will need to decide the strategic

posture they wish to adopt in the carbon transition. Some organisations will seek to play a leading

role, pioneering the adoption of sustainable technologies and business models. Others will adopt a “last man standing” strategy,

seeking to retain their existing approaches for as long as customers and

regulators permit. Between those

extremes, companies may choose to pursue fast-follower or slow-follower

strategies, holding off on major shifts until approaches have been proven

elsewhere (Exhibit 4).

Based on their strategic postures, companies will want to reevaluate their existing portfolios, potentially disposing of assets or exiting certain businesses. In other areas, they will likely need to place their big bets across one or more of three key dimensions: geographies, products, and processes.

— New geographies: Locating manufacturing facilities for less energy-intensive products closer to the point of end use can significantly reduce carbon emissions generated during transportation. For energy-intensive products, proximity to new feedstock sources or sources of low-carbon energy can be even more advantageous. Saudi Arabia, for example, has announced plans to build a new green hydrogen plant powered by 4 gigawatts of wind and solar energy. Much of the plant’s annual hydrogen output will be converted to 1.2 million tons of ammonia and exported worldwide as a low carbon energy source and chemical feedstock. Australia, which has abundant ore resources and significant renewable-energy potential, could become an advantageous location for the production of iron using green hydrogen, for example. The move up the value chain, shifting from an exporter of ore and coking coal to a producer of iron, would generate new value for the region. And, by halving the mass of exported materials, it would have a positive knock-on effect on transport emissions.

— New products: Organisations may choose to shift into lower-emissions product and market segments. Manufacturers of cement-based building components might migrate into engineered timber alternatives. Materials players could invest in novel chemical-based recycling technologies for plastics. Meat and dairy producers could enter new food categories derived from plants, cultured meat, or insect-based sources of protein. That shift is already underway, with major food companies making large investments in the sector. In 2016, dairy products maker Danone made its largest acquisition in a decade with its US$12.5 billion purchase of WhiteWave, owner of the Alpro brand of plant-based foods.

— New processes: In many industries, the known technologies required to deliver net-zero operations are value destroying, if they exist at all. To remain viable, therefore, companies will want to radically reinvent their processes. Heavy industrial sectors face a multiyear effort. Brazilian metals company Tecnored is developing a more energy-efficient process for production of pig iron that uses pellets of powdered ore combined with coal or biomass char as a reducing agent. It has been operating a development plant since 2011 and, having proved that its process is cost-competitive with conventional methods, is now working on a commercial unit with a planned annual capacity of 500,000 tons. In the production of ethylene, Dow and Shell have announced research into electrically powered steam-cracking technology. Elsewhere, laboratory-scale demonstrations have shown that replacing the conventional high-temperature steam-cracking process with chemical looping–oxidative dehydrogenation could reduce carbon emissions by almost 90%, cut operating costs, and debottleneck existing assets.

To succeed in these moves, organisations will want to move more R&D expenditure into sustainability related topics. They have room to do so. In 2020, global R&D expenditure on technologies to fight climate change was estimated at around US$80 billion. That is less than 5% of the world’s US$1.7 trillion R&D budget.

The transition to net-zero emissions will have a profound impact on almost every aspect of business. Success will require a transformational approach. For industries that have relied on the same fundamental technologies for a century or more, the degree of change required in the next three decades may seem formidable, but it is not without precedent. Neither the internet nor the mobile phone had achieved large-scale adoption at the beginning of the 1990s.

Such a transformation must begin with a decarbonisation vision, determining the role the organisation seeks to take through the carbon transition and beyond, and laying out the scale and scope of the operational changes and strategic big bets required to reach it.

Achieving that change at the necessary pace to meet global climate goals will still require companies to juggle thousands of initiatives and develop entirely new technologies, all in an environment of significant uncertainty. That will require careful planning, with development of new decarbonisation “playbooks” that help business prioritise and sequence their carbon-reduction actions. Whatever their strategy, companies must also adapt targets, performance metrics, and decision-making processes across the organisation to ensure that staff at every level are motivated and supported to achieve emissions goals.

Finally, to successfully operationalise their emissions reduction efforts, companies will need to develop new capabilities at a transformational scale. That capability-building effort needs to be broad, equipping the majority of staff with the skills they need to understand and act on sustainability related sustainability data. It also needs to be deep; developing a task force of process optimisation and sustainability specialists that can help site teams to drive rapid improvement, for example.

For any company with ambitions to remain viable beyond the middle of this century, the race to net zero emissions is already under way. Yet, the formidable technical and economic barriers they face has left many organisations stuck in the starting blocks, paralysed by the abatement curve.

Surmounting those barriers will require a transformation mindset

with two primary elements. Beyond the

boardroom, companies will need to operationalise at scale, capturing short-term

value creation opportunities by equipping their frontline staff with new

skills, new tools, new processes, and new infrastructure. Within the boardroom, meanwhile, leaders will

need to rethink their strategic positioning, adapt their existing portfolios, identify

the growth opportunities emerging from the disruption of decarbonisation, and

place big bets on their long-term futures.